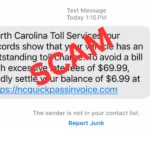

The text message looks legitimate at first glance: “Peach Pass: You have an unpaid toll of $12.50. Pay within 48 hours to avoid a $75 penalty and possible license suspension.” There’s a convenient link to make your payment, and you’re worried about the consequences. But wait—this is exactly how thousands of Georgians are being scammed right now.

The Explosive Growth of Peach Pass Scams

Peach Pass scams have reached unprecedented levels in 2025. The FBI’s Atlanta field office reports receiving a staggering 1,573 complaints about fraudulent Peach Pass texts in just the first two weeks of March—nearly matching the 1,720 complaints filed during the entire previous 14 months.

These “smishing” attacks (combining SMS and phishing) are targeting drivers with fake text messages about unpaid tolls. While officially reported losses stand at just $3,643, authorities believe the actual figure is much higher, as many victims don’t report their losses.

What makes this particularly troubling is how indiscriminate the targeting has become. You don’t need to have a Peach Pass account—or even live in Georgia—to receive these scam messages. The fraudsters are casting a wide net, hoping someone takes the bait.

How the Peach Pass Scam Works

These scams follow a predictable pattern that’s effective because it plays on fear and urgency:

- You receive a text claiming to be from Peach Pass about an unpaid toll

- The message includes a specific amount owed (usually small enough to seem plausible)

- There’s a tight deadline for payment

- The text threatens severe consequences like late fees, legal action, or license revocation

- A link directs you to a fake payment site

- Some versions ask you to reply “Y” to activate the payment link

For example, one victim reported receiving: “Peach-Pass: Unpaid Toll Reminder You have an outstanding toll payment. The payment is due by 03/05/2025. If not paid by the due date, additional late fees may apply, and it may result in the revocation of your driver’s license…”

When you click the link, you’re taken to a convincing replica of the official Peach Pass website. Every detail you enter—from contact information to credit card numbers—goes straight to the scammers.

Red Flags That Scream “Scam!”

Spotting these fraudulent messages isn’t difficult if you know what to look for:

The Communication Method

The biggest red flag is the message format itself. The State Road and Tollway Authority has clearly stated that Peach Pass will never send text messages requesting toll payments or personal information. Genuine toll violations come through official mail, not texts.

The Web Address

Scammers have become increasingly clever with their fake websites. Many now incorporate portions of the legitimate Peach Pass domain (myPeachPass.com) but add random characters or use unusual extensions like .ru or .xin. Always check the complete URL before entering any information.

The Pressure Tactics

Legitimate government agencies rarely create artificial urgency. If a message threatens dire consequences unless you take immediate action, that’s cause for suspicion. The government typically provides reasonable timeframes for addressing issues like toll violations.

The Writing Style

Poor grammar, weird capitalization, and unusual spacing are hallmarks of many scam messages. Professional communications from government agencies are typically well-edited and professionally formatted.

The Request Method

Government agencies generally use .gov domains. If the link directs to a .com or other domain, that’s another warning sign. Additionally, legitimate agencies rarely ask you to confirm receipt by replying to text messages.

What To Do If You Get a Suspicious Text

If you receive a text claiming to be from Peach Pass about unpaid tolls, take these steps:

- Don’t click any links or reply to the message. Even responding with “STOP” confirms your number is active to scammers.

- Report the scam to the FBI’s Internet Crime Complaint Center at www.ic3.gov. Include the sender’s phone number and any website information from the text.

- Mark the message as spam using your phone’s built-in features, then delete it. On iPhones, you can swipe and report as junk, or forward suspicious messages to 7726 (SPAM).

- Check your account directly through the official Peach Pass website (peachpass.com) if you’re genuinely concerned about potential unpaid tolls.

- Take immediate action if you’ve already clicked. Change your passwords, monitor your financial statements closely, and notify your bank of potential fraud.

As cybersecurity expert Jon Powell advised in a recent interview, “Just assume it’s not real… Don’t click on it. Just open the app up or go to the website.”

It’s Not Just Peach Pass: Toll Scams Nationwide

While Georgia’s Peach Pass is currently in the spotlight, similar scams are targeting toll systems across the country. Users of Florida’s SunPass, California’s FasTrak, and other regional systems report receiving nearly identical messages. This suggests a coordinated nationwide campaign against toll system users.

Atlanta News First reporter Anastasia Alalal noted, “This scam is happening all around the country. I’ve actually gotten the scam text for months on both my work phone and personal phone… that includes Fast Track in Los Angeles and Peach Pass right here in Atlanta.”

Beyond Peach Pass: Protecting Yourself from All Smishing Attempts

These toll scams are just one example of the broader “smishing” trend. Here’s how to protect yourself from all types of text message scams:

Verify Through Official Channels

Never click links in unexpected texts regarding bills or accounts. Instead, open your browser and type the official website address manually, or use the company’s official app.

Question Urgent Requests

Legitimate organizations rarely demand immediate action through text messages. If a text creates artificial urgency, it’s likely a scam. Take time to verify before responding.

Guard Your Personal Information

Remember that genuine organizations like Peach Pass have stated explicitly they “will never send you a text message asking for your personal information [or] banking information.” Be extremely cautious about sharing sensitive data.

Use Direct Contact Methods

If you’re concerned about an account status, contact the organization directly using the phone number on your statement or from their official website—not numbers provided in text messages.

Enable Two-Factor Authentication

For all important accounts, enable two-factor authentication where possible. This creates an additional security layer that makes it harder for scammers to access your accounts even if they obtain your password.

The Technology Behind the Scams

Scammers are leveraging several technological advantages to make their fraud more convincing:

Domain Spoofing

By creating websites that visually mimic legitimate ones and using similar domain names, scammers can trick even careful users. Some fake Peach Pass sites are nearly indistinguishable from the real thing at first glance.

Mass Texting Tools

Automated messaging platforms allow scammers to send thousands of texts simultaneously at minimal cost. This enables them to cast a wide net, knowing that even a small percentage of responses can be profitable.

Data Aggregation

Scammers may purchase bulk data from breaches or compile information from public sources to create convincing, personalized messages. This explains why non-Peach Pass users still receive these texts—the scammers simply don’t know who has an account.

Staying One Step Ahead: Future-Proofing Against Scams

As scammers continue to evolve their tactics, consider these proactive measures:

Establish Direct Communication Channels

Set up accounts with companies you regularly do business with and become familiar with their official communication methods. Many legitimate organizations now use secure message centers within their apps rather than sending texts.

Use a Password Manager

Strong, unique passwords for each account significantly reduce your risk. Password managers make this practical by creating and storing complex passwords securely.

Consider a Credit Freeze

For the highest level of protection, consider freezing your credit with all three major credit bureaus. This prevents scammers from opening new accounts in your name even if they obtain your personal information.

Stay Informed

Scammers constantly refine their techniques. Follow trusted security resources and government alerts to stay updated on the latest scam tactics.