Received a text about an unpaid toll you don’t remember? Before you click that link, you might be looking at one of the increasingly sophisticated EZ-Pass scams sweeping across the country. Motorists in multiple states are being targeted with fraudulent messages claiming to be from legitimate toll authorities. What makes these scams particularly dangerous is their use of psychology – they often request tiny amounts like $0.28, making them seem more believable than if they asked for larger sums.

How EZ-Pass Scams Work

These scammers have perfected a simple but effective formula. They send unsolicited text messages claiming you have an unpaid toll, typically for a suspiciously small amount like $0.28. The message includes a shortened link or suspicious URL directing you to a fake payment portal designed to harvest your personal and financial information.

The timing is calculated for maximum effect – many victims report receiving these texts early in the morning when they’re groggy and less likely to scrutinize the message carefully. As one victim confessed on Reddit, “This morning, I received a text instructing me to pay a toll of just $0.28, and without pausing to think, I followed the instructions.”

These fraudsters don’t discriminate in their targeting. You’ll get these texts whether you’ve recently used a toll road or not – even if you don’t own a car. This random targeting confirms these are widespread phishing attempts rather than the result of specific data breaches.

Where These Scams Are Happening

The geographic spread of these scams is alarming. Reports have surfaced across multiple states including:

- New York

- Virginia

- West Virginia

- Pennsylvania

- Maryland

The Pennsylvania Turnpike Commission has specifically issued warnings about these “smishing scams” (SMS phishing) targeting random individuals. One Reddit user noted receiving these messages despite “not owning a car or driving at all,” confirming the indiscriminate nature of the targeting.

Red Flags That Expose the Scam

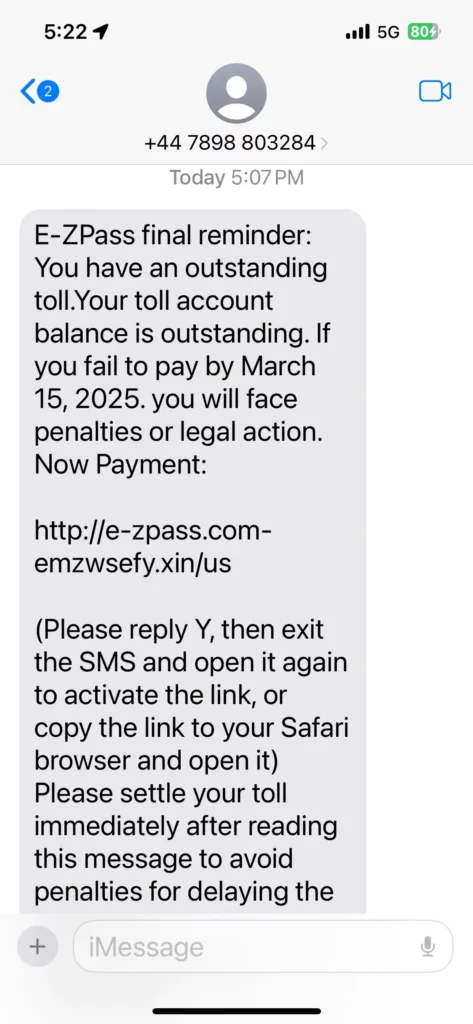

Suspicious Phone Numbers

Pay close attention to the origin of these messages. Many victims report receiving texts from international numbers, particularly those with country codes:

- +44 (United Kingdom)

- +63 (Philippines)

As one Reddit user observed, “Notice that the numbers typically begin with 63, which is the country code for the Philippines.” Legitimate toll authorities use domestic phone numbers for official communications.

Questionable Links and Domains

The URLs in these messages are often obvious red flags if you examine them closely:

Example of fraudulent domains:

- usws.kovddre.shop

- ez-pass.toll-pay.xyz

- payezpass.usatollway.site

These domains bear no resemblance to official transportation authority websites, which typically use government domains (.gov) or established toll authority URLs.

Unusual Communication Methods

Legitimate EZ-Pass services almost never initiate communication via text messages for unpaid tolls. As one truck driver pointed out, “As a truck driver, I’m well aware that EZ Pass does not communicate via text messages like this. Any genuine correspondence from them would arrive through traditional mail.”

Official toll notices typically arrive through:

- Postal mail to your registered address

- Email (only if you’ve explicitly opted in)

- Your official EZ-Pass account portal

Odd Message Content and Tone

The messages themselves often contain tell-tale signs of fraud:

- Grammatical errors and strange phrasing

- Oddly casual or cheerful elements (“Have sunny day ☀😂”)

- Urgent language demanding immediate payment

- Generic greetings rather than addressing you by name

Suspicious Payment Processes

If you’ve proceeded to the payment stage, watch for these additional red flags:

- Multiple rejection messages (“this card type is not supported, please try another”)

- Requests for excessive personal information beyond what’s needed for payment

- Unusual verification requirements not typical of legitimate payment processors

- Redirection to unfamiliar payment platforms

Real Impact on Victims

Financial Consequences

The immediate impact for victims is often financial. Several Reddit users reported having to obtain new credit cards after falling victim to these scams. One commenter urgently advised, “Immediately cancel your cards! They have access to all your card information, and it’s crucial to act fast before they drain your accounts.”

Beyond simple credit card fraud, more sophisticated scammers are using verification codes to add victims’ credit cards to digital wallets. One victim reported, “I received an email indicating that my Chase card had been added to Apple Pay, even though I don’t own an iPhone.” This shows how quickly stolen information can be weaponized.

The Hidden Costs: Time and Peace of Mind

The burden extends far beyond direct financial loss:

- Hours spent on the phone with banks and credit card companies

- The process of updating payment information for legitimate recurring bills

- Ongoing monitoring for additional fraudulent charges

- Anxiety about potential identity theft

- The emotional impact of feeling violated and foolish

As one victim expressed, “I can’t believe I fell for this; I feel so foolish.” This emotional toll shouldn’t be underestimated – the psychological impact of being scammed can linger long after the financial issues are resolved.

How to Protect Yourself

Use Official Channels Only

The safest approach for checking legitimate toll charges is going directly to official sources:

| State | Official EZ-Pass Website |

|---|---|

| New York | www.e-zpassny.com |

| Virginia | ezpassva.com |

| Maryland | www.driveezmd.com |

| Pennsylvania | www.paturnpike.com/toll-by-plate-ez-pass |

| New Jersey | www.ezpassnj.com |

The Pennsylvania Turnpike Commission specifically recommends that “E-ZPass account holders and Toll By Plate customers can use approved safe methods to check their accounts such as the official PA Turnpike E-ZPass website or the PA Toll Pay app available from the Apple App Store, or Google Play store.” This direct approach bypasses the risk entirely.

Create Personal Security Rules

Establish personal protocols that protect you during vulnerable moments:

- Never click links in text messages related to tolls or payments

- Set specific times to handle financial matters when you’re fully alert

- Use a secure computer rather than your phone for financial transactions

- Create a personal rule to verify all unexpected payment requests through official channels

- Wait at least an hour before responding to any unexpected financial message

As one Reddit user suggested, “I prefer to make vendor payments at specific times during the week, ideally using a computer. I avoid any business communication via text, and I definitely won’t engage with texts or emails from senders I don’t recognize.”

Know How Legitimate Services Communicate

Understanding authentic communication patterns is crucial for spotting fakes:

- Legitimate toll authorities send physical mail for violations and unpaid tolls

- Official communications include specific details about the toll location, date, and time

- Real EZ-Pass communications never ask for your Social Security Number

- Official messages typically reference your license plate number or EZ-Pass account

- Legitimate services don’t use urgency or threats of immediate consequences

As noted by one Reddit user, “E-ZPass New York will never ask for a customer’s Date of Birth, Social Security Number, or other personally identifiable information.” Any text requesting such details should raise immediate suspicion.

If You’ve Been Targeted: Action Plan

If You’ve Already Provided Information

Time is critical if you’ve fallen for one of these scams:

- Contact your bank or credit card company immediately – Report the fraud and request new cards with different numbers

- Monitor your accounts closely – Check for unauthorized charges several times daily for the next few weeks

- Check for digital wallet additions – Verify no unauthorized devices or wallets have been linked to your cards

- Change passwords – Update credentials for any financial accounts or email addresses that might be compromised

- Check your credit reports – Place fraud alerts with the major credit bureaus (Experian, Equifax, TransUnion)

Reporting the Scam

Help authorities track and combat these scams by reporting them:

- File a complaint with the FBI’s Internet Crime Complaint Center at www.ic3.gov

- Report the scam to your state’s toll authority

- Forward suspicious text messages to SPAM (7726)

- Report the scam to your mobile carrier

- Document everything including screenshots of messages, links, and any websites visited

If You’ve Only Received Messages

If you’ve received these texts but haven’t clicked or provided information:

- Delete the message immediately

- Block the sender (though they often use different numbers)

- Consider installing spam-filtering apps on your phone

- Stay vigilant, as receiving one scam message often means you’ll receive more

- As one Reddit poster advised, “DO NOT CLICK THEIR LINK. Just delete it and/report it.” This remains the most effective protection.

The Evolving Threat Landscape

Why These Scams Persist

Despite increased awareness, these scams continue to proliferate for several reasons:

- Their success rate remains high enough to be profitable

- The low cost of sending mass text messages

- Minimal risk to scammers operating internationally

- Continued evolution of tactics to bypass awareness campaigns

- The universal nature of toll roads makes them a convincing pretext

Many Reddit users report receiving these messages repeatedly over weeks or months, with one noting, “I’ve gotten a half dozen of these this week. Reported and blocked all of them, they keep coming.” This persistence indicates that scammers find these tactics effective enough to continue investing resources in them.

Official Responses

Transportation authorities are actively fighting back. The Pennsylvania Turnpike Commission has warned that “a smishing scam is again being sent to random individuals, aiming to deceive them to share their personal financial information to settle outstanding toll amounts.”

State authorities are increasingly implementing:

- Public awareness campaigns

- Coordinated efforts with law enforcement

- Clear communication about legitimate toll collection methods

- Enhanced security measures for official payment processes

Latest Scam Variations

The most concerning development is the increasing sophistication of these scams:

- Integration with digital wallet verification systems

- Use of spoofed local phone numbers instead of international ones

- Employment of AI to create more convincing message content

- Creation of more realistic payment portals that mirror official sites

- Coordination with other scam types for maximum effect

How Toll Systems Actually Work

Understanding how legitimate toll collection functions helps spot imposters:

| Toll Collection Method | How Unpaid Tolls Are Handled |

|---|---|

| EZ-Pass Transponder | Charges automatically deducted from linked account; low balance notifications sent via opted-in methods |

| License Plate Recognition | Bill sent to registered address; follow-up notices for non-payment |

| Cash Lanes | No follow-up needed as payment is made on-site |

For legitimate toll violations, the process typically involves:

- Identification of the vehicle via transponder or license plate

- Attempt to charge linked EZ-Pass account or generate a toll-by-mail invoice

- Mailing of a physical notice to the registered address

- Multiple notice attempts before any penalties

- Option to contest or pay through various official channels

As one Reddit user correctly noted, “Anyone with a bit of common sense would realize that if they passed through an EZ Pass lane, they should either settle the payment online or expect to receive a bill in the mail.”

Beyond EZ-Pass: Related Scams to Watch For

The success of EZ-Pass scams has inspired similar fraud schemes targeting drivers:

Parking Ticket Scams

Similar to toll scams, these messages claim you have an unpaid parking ticket that requires immediate payment, often with escalating penalties if not addressed quickly. Legitimate parking enforcement agencies use physical tickets on vehicles and mail official notices.

Vehicle Registration Renewal Frauds

These scams send texts or emails claiming your vehicle registration is about to expire, requiring immediate renewal through their “convenient” link. Always verify through your state’s DMV official website.

Traffic Camera Violation Notices

Fraudulent messages claim you’ve been captured by a traffic camera running a red light or speeding. These scams typically include a link to view the “evidence” which actually installs malware or leads to payment portals.

Insurance Discount Offers

These schemes send messages claiming to offer significant discounts on auto insurance through “special partnerships” with your current provider. They’re designed to collect personal information and payment details.

The Technology Behind the Scams

Understanding how these scams operate technically can help you better protect yourself:

SMS Spoofing Tools

Scammers use specialized software to send text messages that appear to come from different phone numbers, making blocking ineffective and tracing difficult. Some can even make messages appear to come from semi-official looking sender names rather than phone numbers.

Temporary Website Creation

The fraudulent payment portals are typically hosted on temporarily registered domains using templates that mimic official sites. They’re designed to collect information and then disappear before authorities can take action.

Data Collection Mechanisms

The fake payment portals often employ sophisticated data collection tools that harvest not just the information you actively enter, but potentially also:

- Browser fingerprinting information

- Device details

- Location data

- Other stored credentials

Distribution Networks

These scams are typically run by organized groups that purchase phone number lists from data brokers or dark web sources. They may target specific geographic areas where particular toll systems operate but often cast wide nets to maximize potential victims.

Building Digital Resilience

Beyond specific tactics for EZ-Pass scams, developing broader digital resilience skills helps protect against all types of fraud:

The Five-Second Rule for Unexpected Messages

Before responding to any unexpected message requesting action:

- Stop and take a deep breath

- Ask yourself if you were expecting this communication

- Question why they’re contacting you by text rather than mail

- Consider if the request makes logical sense

- Verify through official channels before taking any action

Teaching Vulnerable Family Members

Take time to educate potentially vulnerable family members, especially:

- Elderly relatives who might be less familiar with digital scams

- Young adults new to financial responsibility

- Anyone who tends to respond quickly without verification

Establish family protocols for verifying unexpected financial requests, creating a safety net of consultation before action.

Creating a Verification Habit

Develop the habit of independent verification for any financial request:

- Never call numbers provided in the suspicious message

- Type official websites directly into your browser

- Use official apps downloaded from legitimate app stores

- Call official numbers listed on your toll tags or account statements

- Wait until you’re fully alert and at a secure device before taking action

As we navigate an increasingly complex digital landscape, these EZ-Pass scams represent just one facet of the broader challenge of digital security. By understanding their methods, recognizing warning signs, and establishing good verification habits, you can protect yourself not just from toll scams but from the full spectrum of digital threats targeting your financial information.