That forgotten toll might seem insignificant now, but when it lands in collections, it can quickly transform into a serious financial and legal headache. Whether you missed an E-ZPass payment or drove through an electronic toll without a transponder, understanding what happens next could save you hundreds of dollars and prevent registration suspensions.

How Tolls Progress to Collections

The Notification Timeline

When you miss a toll payment, you’re not immediately sent to collections. Toll authorities typically follow a structured notification process:

- Initial notice (usually 15-30 days after the toll)

- Second notice with added fees (30-45 days later)

- Final warning notice (45-60 days later)

- Transfer to collections (usually 90-120 days after initial toll)

In New York, for example, accounts move to collections when drivers don’t pay within 120 days after receiving three separate notices over a 90-day period. The New York State Thruway Authority reported a staggering $276.3 million in unpaid tolls and fees in collection status as of March 2023.

When Small Tolls Become Big Problems

The most shocking aspect of toll collections is how quickly minimal charges can balloon into substantial debts:

| Original Toll | Collection Amount | Increase |

|---|---|---|

| $1.25 | $101.25 | 8,000% |

| $6.00 | $106.00 | 1,667% |

| $12.50 | $187.50 | 1,400% |

This dramatic multiplication happens because of administrative fees. In Virginia, toll operators can charge fees “reasonably related to the actual cost of collecting the unpaid toll” with a maximum of $100 per violation. However, if paid within 60 days of notification, this fee cannot exceed $25 – a powerful incentive to pay promptly.

Legal Consequences of Unpaid Toll Collections

Your Vehicle Registration at Risk

Perhaps the most effective enforcement tool in the toll authority arsenal is the ability to suspend your vehicle registration. In New York, your registration can be suspended if you:

- Fail to pay tolls related to three or more violations within a five-year period

- Accumulate unpaid tolls and fees totaling $200 or more within five years

Don’t think registration suspension is just an inconvenience. In many states, driving with a suspended registration is a misdemeanor that can result in fines, impoundment of your vehicle, and even imprisonment in some cases.

Florida toll authorities can place holds on your license plate renewal until all outstanding balances are settled, effectively forcing payment before you can legally drive your vehicle again.

Civil Penalties Through the Court System

When toll disputes reach the courts, you’ll face standardized civil penalties that increase with repeated offenses. Virginia’s system demonstrates this escalating approach:

- First offense: $50

- Second offense within one year: $100

- Third offense within two years of the second: $250

- Fourth and subsequent offenses within three years: $500

These penalties apply on top of the unpaid toll and all administrative fees, creating a substantial financial burden that can quickly reach thousands of dollars for repeat offenders.

Impact on Your Credit Score

Do Unpaid Tolls Affect Your Credit?

There’s confusion about whether toll debt appears on credit reports. Technically, toll road debt “is not a consumer debt and should not appear on credit reports,” according to credit attorneys. However, once your unpaid tolls transfer to a collection agency, that agency may report the debt to credit bureaus.

Several Reddit users report finding toll collections on their credit reports despite the technical distinction. This inconsistency creates uncertainty about the credit impact of unpaid tolls.

The Never-Ending Collection Timeline

Unlike many other debts, toll collections can continue indefinitely with no strict statute of limitations. As one financial advisor noted, “There’s no statute of limitation on collection calls. The 7 years is for your credit report. They can continue to attempt to collect the debt till the end of time.”

While collection agencies can contact you indefinitely, you maintain rights under the Fair Debt Collection Practices Act (FDCPA) to request they stop contacting you. If they continue calling after you’ve made this request in writing, it constitutes an FDCPA violation that you can potentially use for legal action.

How Collection Agencies Handle Toll Debt

Aggressive Collection Tactics

Once toll authorities transfer your debt to a collection agency, you’ll likely experience more aggressive collection efforts:

- Frequent phone calls to your home and workplace

- Multiple collection letters with increasing urgency

- Threats of legal action or registration suspension

- Attempts to settle for slightly reduced amounts

Collection agencies typically purchase toll debt for pennies on the dollar or work on a commission basis, giving them strong incentive to collect by any legal means possible.

Settlement Options With Collectors

Collection agencies often have authority to settle for less than the full amount, particularly for older toll debt. When negotiating, remember:

- Get any settlement agreement in writing before making payment

- Specify that the settlement represents “payment in full”

- Request written confirmation that they’ll report the debt as “settled” to credit bureaus

- Keep records of all communications and payments indefinitely

Even a small unpaid toll from years ago can resurface unexpectedly, so maintaining documentation of resolution is essential.

Relief Programs and Consumer Protections

State Assistance Programs for Toll Debt

Several states offer programs to help drivers facing toll collections, particularly those with financial hardships:

The Illinois Tollway provides “I-PASS Assist” for income-eligible customers, offering lower prepayment requirements, waived transponder deposits, and invoice fee dismissals upon activation of an I-PASS account.

Illinois also offers a “Last Chance Discount” providing up to 50% off fees for customers with outstanding toll invoices issued within specific timeframes.

These programs aim to help financially vulnerable drivers comply with toll requirements without facing disproportionate penalties.

How to Dispute Incorrect Toll Charges

If you believe you’ve received toll violations in error, most authorities provide formal dispute processes:

- Contact the toll authority’s customer service directly (not the DMV)

- Submit disputes in writing with any supporting evidence

- Request a formal review of your toll charges

- Consider requesting a payment plan while the dispute is resolved

New York’s E-ZPass system directs customers to contact their Customer Service Center at 1-800-333-TOLL (8655) to dispute allegations of toll violations.

Remember that these dispute processes typically operate through the toll authority itself rather than through motor vehicle departments. The New York DMV explicitly states: “DO NOT contact the New York State DMV to dispute whether you violated a toll regulation or failed to pay the toll, fees, or other charges.”

Strategies to Avoid Toll Collections

Keep Your Toll Accounts Current

The best defense against toll collections is preventing them entirely:

- Maintain a positive balance in your E-ZPass or equivalent account

- Update your license plate information when you get a new vehicle

- Keep your credit card information current to avoid failed auto-payments

- Check your toll account monthly for unexpected charges

Many toll systems now offer text or email notifications when your balance drops below a certain threshold, helping you avoid unintentional delinquency.

Address Toll Notices Immediately

If you do receive a toll notice:

- Pay the original toll amount within the first notice period to avoid fees

- If you can’t pay in full, contact the toll authority about payment plans

- Keep proof of payment for at least five years

- Update your address with the DMV so notices reach you promptly

A small toll paid promptly costs a fraction of what you’ll pay after it enters collections. A $2 toll paid within 30 days remains $2. That same toll, if ignored, can exceed $100 within months.

Electronic Tolling Systems and Collection Challenges

How Modern Tolling Creates Collection Issues

The shift to cashless, electronic tolling has increased the number of tolls entering collections:

- Drivers without transponders often don’t realize they’ve incurred a toll

- Plate recognition systems may misread plates or assign tolls to incorrect vehicles

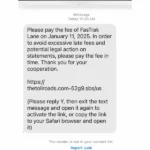

- Tourists and out-of-state drivers may discard toll notices as junk mail

- Electronic billing requires current address information at DMV records

Illinois Tollway reports that approximately 7% of all tolls eventually enter some stage of the collections process, a figure that has increased since the implementation of fully electronic tolling.

Cross-State Enforcement of Toll Collections

Toll authorities increasingly cooperate across state lines, sharing violation information and enforcement capabilities. This regional cooperation eliminates the old strategy of ignoring out-of-state toll notices:

- New York, New Jersey, Pennsylvania, Delaware, and Maryland share toll violation data

- Florida and Georgia exchange toll enforcement information

- E-ZPass states (18 and growing) have integrated violation processing

If you receive an out-of-state toll notice, treating it with the same urgency as an in-state notice is essential, as your home state may enforce collections on behalf of other jurisdictions.

The Future of Toll Collections

Technological Improvements in Toll Payment

Toll authorities are implementing new technologies to reduce collections:

- Mobile apps that allow immediate toll payment after driving through

- License plate-linked payment options that don’t require transponders

- Artificial intelligence to improve license plate reading accuracy

- Text message alerts when a toll is incurred by your vehicle

These innovations aim to reduce the number of tolls reaching collections by making payment more accessible and transparent.

Legislative Reform Efforts

Several states have introduced legislation to reform toll collection practices:

- Caps on administrative fees relative to the original toll amount

- Requirements for more notices before collections

- Reduction of penalties for first-time offenders

- Expanded hardship programs for low-income drivers

Consumer advocates argue that $100+ fees on $1-2 tolls are disproportionate and predatory, pushing for fee structures that more accurately reflect the actual administrative costs of collection.