Ever glanced at your credit card statement and wondered about that “E-ZPASS REBILL” charge? You’re not alone. These recurring charges can be confusing if you don’t know exactly what they represent or how the E-ZPass system works behind the scenes.

Let’s break down everything you need to know about E-ZPass rebill charges, how to manage them, and how to protect yourself from potential scams.

What Exactly Is an “E-ZPass Rebill” Charge?

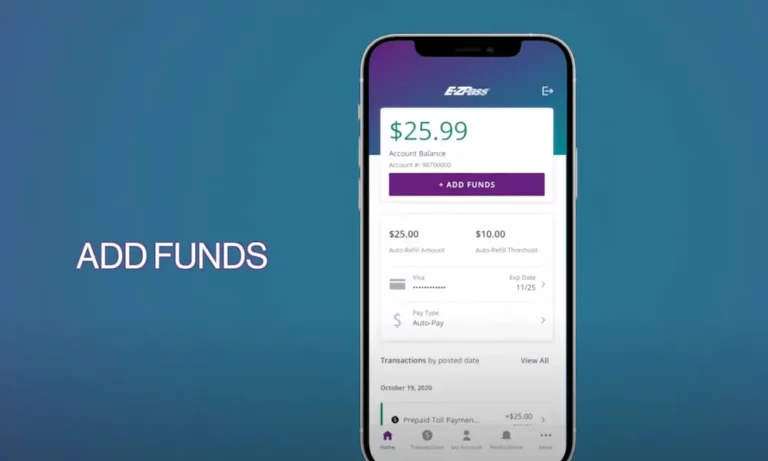

The term “rebill” might sound like you’re being charged twice, but that’s not the case. An E-ZPass rebill charge is simply the automatic replenishment of your E-ZPass account when your balance drops below a certain threshold.

Since E-ZPass is a prepaid system, your account needs funds available to pay for tolls. When your balance gets low, the system automatically charges your payment method to reload your account. This charge typically appears on your statement as “E-ZPASS REBILL EZP REBILL” or something similar.

Important to note: This isn’t an extra fee—it’s money being added to your account for future toll payments.

How the E-ZPass Replenishment System Works

Your E-ZPass account has two important balance thresholds:

- Low Balance Threshold – When your account reaches this level (typically around 50% of your replenishment amount), you’ll start seeing “Low Balance” messages when passing through toll plazas.

- Replenishment Threshold – When your balance drops to or below this level (often 25% or $10 of your rebill amount), the system automatically reloads your account.

For example, if you set up a $25 replenishment amount, your account might trigger a reload when the balance drops to $6.25 (25%) or lower.

Automatic Replenishment Methods

Most E-ZPass users opt for automatic replenishment using:

- Credit cards

- Debit cards

- Direct bank account debits

With automatic replenishment, you don’t have to worry about running out of funds. The system handles everything in the background.

One-Time Payment Options

If you prefer more control, you can choose one-time payments instead:

- Cash (only available in person at service centers)

- Check or money order (by mail)

- One-time credit/debit card payment (online, by phone, or in person)

The downside? You’ll need to monitor your balance carefully and make regular payments to avoid running out of funds.

How to Identify Legitimate E-ZPass Rebill Charges

When reviewing your statements, E-ZPass rebill charges might appear in various ways:

- “E-ZPASS REBILL EZP”

- “E-ZPASS REBILL EZP REBILL”

- “ACH DEBIT E-ZPASS REBILL EZP_REBILL”

These are all legitimate charges representing automatic account replenishment. Different E-ZPass agencies and banks might display the transaction slightly differently.

If you travel frequently or during high-toll periods, you might see multiple replenishment charges in a single billing cycle. This doesn’t mean something’s wrong—just that you’re using your E-ZPass more than usual.

Why Your E-ZPass Replenishment Amount Might Change

Your initial replenishment amount is set when you open your account, but it might change over time based on:

- Increased usage – If you start taking more toll roads, the system might increase your replenishment amount to cover your typical monthly usage.

- Toll increases – When toll rates go up, your replenishment amount might adjust accordingly.

- Account adjustments – The E-ZPass agency might periodically review and adjust your replenishment amount to match your actual usage patterns.

Managing Your E-ZPass Account Effectively

Setting Up Online Account Access

The easiest way to manage your E-ZPass is through online account access:

- Visit your state’s E-ZPass website

- Register for an online account using your E-ZPass account number

- Set up your username and password

Once logged in, you can view your account history, update payment information, and monitor your balance.

Tracking Your Account Activity

Even with automatic replenishment, it’s smart to keep tabs on your account:

- Check your account activity occasionally to verify all charges are yours

- Watch for any unusual transactions

- Make sure toll amounts seem appropriate for the roads you’ve traveled

Keeping Your Account Information Current

To avoid account issues:

- Update your credit card before it expires

- Add or remove vehicles as needed

- Keep your contact information current

- Replace your transponder every few years (the batteries do eventually die)

Common E-ZPass Account Issues and Solutions

Unexpected Account Depletion

If your account balance seems to be dropping faster than expected, check for:

- A malfunctioning transponder that’s not reading properly (resulting in higher video toll rates)

- Unauthorized use of your transponder

- Recent toll increases you weren’t aware of

Replenishment Payment Failures

If your automatic replenishment payment gets declined:

- Your credit card might have expired

- Your bank account might have insufficient funds

- Your payment method information might need updating

When a replenishment payment fails, many E-ZPass systems will temporarily switch your account to manual replenishment mode, requiring you to make a payment to reactivate automatic replenishment.

V-Toll Charges

“V-toll” or video toll charges happen when your transponder isn’t read properly at a toll plaza. This can occur if:

- Your transponder isn’t mounted correctly

- The transponder battery is dying

- You’re using a transponder in a different vehicle than registered

These V-toll charges are often higher than regular E-ZPass rates, so make sure your transponder is properly mounted and functioning.

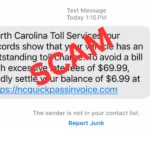

Avoiding E-ZPass Scams

Unfortunately, scammers target E-ZPass users with fake notices about unpaid tolls or account issues.

Common E-ZPass Scams

Be wary of:

- Phishing emails claiming you have unpaid tolls or violations

- Text messages with links to “verify” your account information

- Phone calls demanding immediate payment for alleged toll violations

- Fake websites that mimic official E-ZPass sites

The MTA and New York State Thruway Authority have issued warnings about these phishing attempts targeting E-ZPass customers.

Red Flags to Watch For

Legitimate E-ZPass communications will never:

- Demand immediate payment under threat of severe penalties

- Ask for payment via unusual methods like gift cards or wire transfers

- Request your full credit card number or SSN via email or text

- Contain poor grammar or spelling errors

- Come from strange email domains (official emails come from your state’s E-ZPass domain)

How to Protect Yourself

If you receive a suspicious message:

- Don’t click any links in the message

- Never respond with personal information

- Contact your E-ZPass customer service center directly using official contact information

- Report the scam to your E-ZPass agency and delete the message

E-ZPass Rebill vs. Other Charges

It’s important to understand the difference between various E-ZPass charges:

| Charge Type | What It Means | How It Appears on Statements |

|---|---|---|

| Rebill Charge | Normal account replenishment | “E-ZPASS REBILL EZP” |

| Toll Violation | Unpaid toll with added fees | “E-ZPASS VIOLATION” |

| Service Fee | Annual or monthly account maintenance fee | “E-ZPASS SERVICE FEE” |

| Administrative Fee | Fee for account changes or disputes | “E-ZPASS ADMIN FEE” |

State-by-State E-ZPass Differences

While E-ZPass is interoperable across states, some policies vary:

| State | Minimum Initial Balance | Typical Replenishment Threshold | Special Features |

|---|---|---|---|

| New York | $25 | 25% of replenishment amount | Pay Per Trip option available |

| New Jersey | $25 | When balance falls below $10 | Discount plans for frequent users |

| Pennsylvania | $35 | When balance falls below $10 | Annual service fee applies |

| Maryland | $25 | 25% of replenishment amount | Commuter discount plans |

| Massachusetts | $20 | When balance falls below $10 | No transponder deposit required |