Thinking about getting Ford Premium Care for your vehicle? While it’s Ford’s most comprehensive extended service plan covering over 1,000 components, there are significant gaps you should know about before signing on the dotted line. Let’s break down exactly what isn’t covered so you can avoid those surprise repair bills down the road.

Routine Maintenance Items You’ll Still Pay For

Ford Premium Care doesn’t handle your regular maintenance needs. You’re still responsible for these common wear items:

- Brake components: All those parts that naturally wear down—pads, rotors, drums, shoes, and linings

- Fluids and filters: Oil, coolant, transmission fluid, and all those filters that need regular changing

- Belts and hoses: Including timing belts, serpentine belts, and various engine hoses

- Spark plugs and wires: These regular replacement items aren’t in the plan

- Clutch discs: For those driving manual transmissions

- Tires and tire services: Rotations, balancing, and alignments are all on you

These exclusions align with industry standards, as routine maintenance items are considered the owner’s responsibility rather than protection plan territory.

Exterior and Interior Cosmetic Components

Your vehicle’s appearance items fall outside the Premium Care umbrella:

- Glass elements: Windshield, windows, and mirrors

- Paint and body: All exterior paint, rust issues, corrosion damage

- Body panels: Bumpers, trim pieces, moldings, and sheet metal

- Interior trim: Dash pad, upholstery, carpets, knobs, and fabric

- Weather protection: Weatherstrips and convertible tops (if applicable)

- Wheels: The wheels themselves, wheel covers, and studs

According to Ford’s official terms and conditions, these items aren’t covered because they’re considered either cosmetic in nature or subject to environmental wear.

Lighting System Exclusions

Unless you’ve specifically purchased additional coverage, these lighting components aren’t protected:

- Standard bulbs: All incandescent and halogen bulbs

- Advanced lighting: HID (High Intensity Discharge) lamps

- LED components: Complete LED lamp assemblies and headlamps

- Moisture issues: Fogging or condensation inside lamp assemblies

The Ford Premium Care brochure confirms these lighting exclusions, which can be particularly costly for vehicles with advanced lighting systems.

Performance Modifications and Aftermarket Parts

If you’re thinking about modifying your Ford, know that certain changes will void your coverage:

- Performance enhancements: Non-factory turbochargers, superchargers, or other power adders

- Racing components: Any parts designed for competition use

- Suspension modifications: Lift kits, lowering kits, or oversized tires

- Engine modifications: Aftermarket exhaust systems or intake changes

- Computer alterations: ECU tuning or PCM reprogramming

- Alternative fuel systems: CNG or LPG conversions

Ford enthusiasts have extensively discussed these limitations in forums like Mustang6G, where owners share experiences with warranty denials related to modifications.

Damage-Related Exclusions

Ford Premium Care won’t cover repairs stemming from:

- Environmental damage: Hail, floods, tree sap, salt, or other environmental contaminants

- Accidents: Collision damage or any physical impact

- Malicious acts: Theft, vandalism, terrorism, or war damage

- Improper use: Overloading your vehicle or using it as a stationary power source

- Negligence: Continuing to drive with obvious mechanical issues

- Foreign object damage: Anything that strikes or enters your vehicle

This table summarizes common damage scenarios and their coverage status:

| Damage Type | Covered by Premium Care | Typically Covered By |

|---|---|---|

| Collision | ❌ No | Auto insurance (collision) |

| Hail/Weather | ❌ No | Auto insurance (comprehensive) |

| Engine failure from lack of oil | ❌ No | Nothing (owner negligence) |

| Engine failure from defect | ✅ Yes | Premium Care |

| Vandalism | ❌ No | Auto insurance (comprehensive) |

High-End and Performance Vehicle Exclusions

Some vehicles are entirely excluded from Ford Premium Care eligibility:

- Luxury brands: Aston Martin, Bentley, Ferrari, Lamborghini, Rolls Royce, Tesla

- Ford performance models: Ford GT, Mustang Shelby GT500KR, Roush/Saleen modified vehicles

- Other performance vehicles: BMW M series, Mercedes-AMG, Nissan GT-R, Corvette Z06/ZR1

These exclusions make sense when you consider that high-performance vehicles have specialized components and higher repair costs that fall outside standard extended warranty models.

Maintenance and Service Requirements That Void Coverage

Your Premium Care coverage can be denied or voided if:

- You skip required scheduled maintenance according to Ford’s guidelines

- Your odometer is tampered with or remains broken for more than 90 days

- Your vehicle has a salvage title or other branded status

- The issue stems from a pre-existing condition before you purchased the plan

These requirements are clearly outlined in the official Ford Protect documentation, emphasizing that proper maintenance is essential for keeping your coverage valid.

Geographic and Usage Limitations

Ford Premium Care has some specific boundaries regarding where and how you use your vehicle:

- Commercial vehicles: Taxis, police cars, emergency vehicles, and limousines aren’t covered

- International travel: Operation outside the US, Canada, Mexico, and specified territories

- Incomplete vehicles: Chassis cabs, cutaways, and stripped chassis have limited coverage

These limitations protect Ford from covering vehicles used in ways that cause extraordinary wear or operate in regions where authorized service may be unavailable.

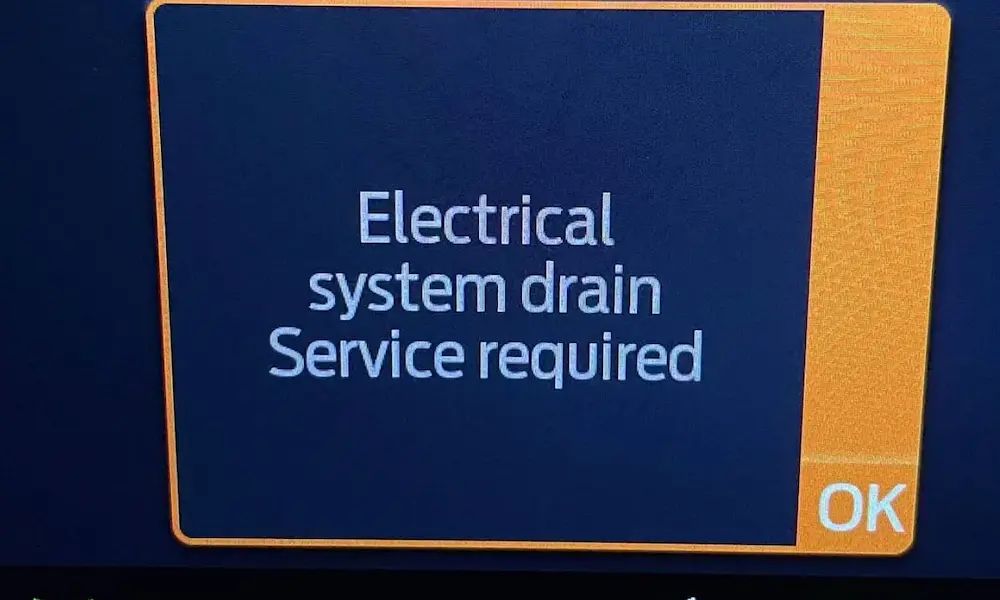

Electric Vehicle Specific Exclusions

EV owners should be particularly aware that Premium Care doesn’t cover:

- Main power cell batteries: The most expensive component in your electric vehicle

- High-voltage battery systems: These are instead covered under a separate 8-year/100,000-mile warranty

The Mach-E Forum community has discussed these limitations extensively, noting that while Premium Care offers value for EVs, the battery exclusion is significant.

Understanding Timeframe and Mileage Limitations

Even covered components have limitations based on:

- Plan duration: Once your plan term ends, all coverage stops regardless of component

- Mileage caps: Coverage expires when you hit your mileage limit, even if time remains

- Progressive coverage reduction: Some plans reduce coverage for higher-mileage vehicles

The warranty experts at Lombard Ford explain that understanding these limitations is crucial for maximizing the value of your Premium Care plan.

The Fine Print: Administrative Exclusions

Some lesser-known exclusions in the fine print include:

- Diagnostic time limitations: Excessive diagnostic time may not be fully covered

- Consequential damage: Damage to covered parts caused by non-covered parts

- Fasteners and connectors: Unless specifically related to a covered repair

- Software updates: Unless directly related to a covered component failure

- Rental car limitations: Specific caps on rental reimbursement

According to Reddit discussions, these administrative exclusions are where many owners encounter frustration with their coverage.

How to Maximize Your Ford Premium Care Coverage

To get the most from your plan despite these exclusions:

- Keep detailed maintenance records: Document every service to prevent warranty disputes

- Address issues promptly: Don’t continue driving with warning lights or obvious problems

- Use authorized service centers: Non-Ford repairs may complicate coverage claims

- Understand your specific plan: Coverage varies by level and purchase date

- Check for add-ons: Some exclusions can be covered with additional protection packages

The Ford Protect FAQ page provides guidance on how to maintain valid coverage and navigate the claims process effectively.

The Value Proposition: Is Premium Care Worth It?

When evaluating whether Premium Care makes sense despite these exclusions, consider:

- Vehicle reliability: Research your specific model’s common issues

- Repair cost potential: Some components cost thousands to replace

- Your driving habits: High mileage drivers may benefit more

- Ownership duration: Plans make more sense for long-term ownership

- Peace of mind value: The psychological benefit of reduced repair anxiety

Many Ford owners on forums like Ford Raptor Forum report satisfaction with Premium Care despite the exclusions, particularly those who’ve experienced covered major repairs.

Ford Premium Care offers substantial protection for your vehicle, but understanding what’s not covered is just as important as knowing what is. By being aware of these exclusions, you can make a more informed decision about whether this extended service plan aligns with your needs and expectations.