Car repair bills can hit you when you least expect them. That timing between when your factory warranty ends and when major components typically fail is exactly where Ford’s extended warranty aims to fit in. But is shelling out extra cash for that peace of mind actually worth it?

What Exactly Is a Ford Extended Warranty?

Ford’s extended warranty, officially called Ford Protect Extended Service Plans (ESP), picks up where your standard warranty leaves off. These aren’t technically warranties but service contracts backed directly by Ford.

Ford offers four main coverage levels:

- PremiumCARE – The most comprehensive option covering 1,000+ components including high-tech features and complex systems

- ExtraCARE – Middle-tier coverage for 113 components

- BaseCARE – Basic protection for 84 components

- PowertrainCARE – Limited coverage for 29 essential powertrain parts

Ford also offers specialized plans for electric vehicles that address batteries, motors, and charging components.

How Much Does a Ford Extended Warranty Cost?

Price is where many owners hesitate – and reasonably so. Ford extended warranties aren’t cheap, but costs vary significantly based on:

| Coverage Level | Typical Price Range | Best For |

|---|---|---|

| PremiumCARE | $1,900 – $4,000+ | Tech-heavy vehicles, long-term owners |

| ExtraCARE | $1,500 – $2,800 | Mid-range protection |

| BaseCARE | $1,300 – $2,200 | Budget-conscious owners |

| PowertrainCARE | $1,000 – $1,800 | Basic protection only |

These prices can climb even higher for luxury models, longer terms, or low deductibles. Ford does offer interest-free payment plans for up to 30 months, which helps spread out the cost.

The Clear Benefits of Ford’s Extended Coverage

Genuine Ford Parts and Factory-Trained Technicians

Unlike third-party warranties, Ford’s plans ensure your vehicle gets repaired with genuine OEM parts by technicians specifically trained on Ford vehicles. This keeps your car running as the engineers intended.

Valuable Additional Perks

Ford’s extended warranty includes extras that add real value:

- Rental car reimbursement (up to $60 per day for 10 days)

- 24/7 roadside assistance including towing, lockout help, and fuel delivery

- Travel expense coverage if you break down far from home

- Transferability to a new owner (potentially boosting resale value)

As noted on Ford Protect’s official website, these plans provide nationwide service at any Ford or Lincoln dealership – a major advantage over independent shops with limited locations.

Protection Against Inflation

Auto repair costs rise yearly. An extended warranty locks in today’s repair prices for future problems. A single major repair in 2027 could cost significantly more than the same repair today.

The Potential Drawbacks

Not Everything Is Covered

Even the comprehensive PremiumCARE plan excludes:

- Regular maintenance items (oil changes, tire rotations)

- Wear and tear components (brake pads, wipers, bulbs)

- Damage from accidents or neglect

- Cosmetic issues

The Statistical Gamble

Extended warranties are a numbers game. Ford and other warranty providers profit because most customers pay more for coverage than they receive in repair benefits.

For highly reliable models like the F-150, statistical data suggests you might pay for protection you’ll never use. However, for tech-heavy vehicles like the Mustang Mach-E, the equation might tip in your favor.

Potential Service Delays

Some owners report waiting weeks for repairs due to parts availability issues, particularly for complex components. While the rental car coverage helps, extended downtime remains a frustration.

Ford Protect vs. Third-Party Warranty Options

When comparing Ford’s factory-backed plans against independent warranty companies, several key differences emerge:

| Feature | Ford Protect | Third-Party Warranties |

|---|---|---|

| Repair Locations | Any Ford/Lincoln dealer | Limited approved shops |

| Parts Used | Genuine Ford OEM | Often aftermarket |

| Claims Process | Direct dealer billing | Reimbursement model |

| Customer Service | Ford-trained staff | Varies widely |

While third-party warranties sometimes advertise lower prices, they often impose repair caps, require multiple inspections, or deny claims for pre-existing conditions. When a Ford Extended Warranty Makes Financial Sense

You Plan to Keep Your Vehicle Long-Term

If you’ll drive your Ford well beyond the factory warranty period (typically 3 years/36,000 miles), an extended plan could provide valuable protection during years 4-8 when major repairs become more likely.

You Own a Tech-Heavy or Complex Model

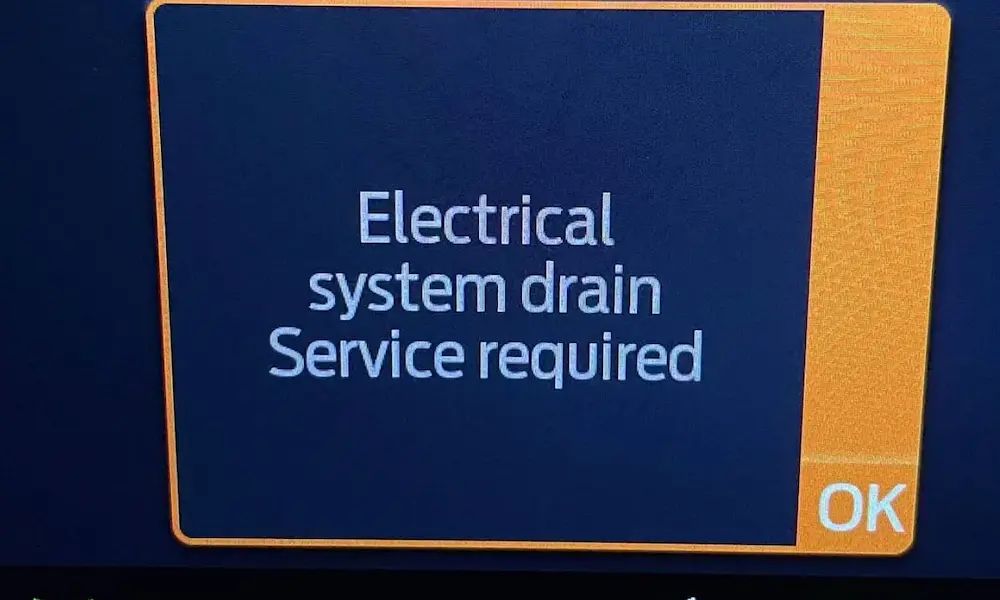

Modern Fords pack increasingly complex technology:

- Digital dashboards

- Advanced driver assistance systems

- Turbocharged engines

- Complex infotainment systems

These sophisticated components can cost thousands to repair when they fail. For instance, replacing a failed touchscreen in a modern Ford can exceed $1,500.

You Prefer Predictable Expenses

Some people would rather pay a fixed monthly amount than risk an unexpected $2,000+ repair bill. If budget predictability matters to you, an extended warranty offers peace of mind that might be worth the premium.

When to Skip the Extended Warranty

You’re Buying a Historically Reliable Model

Some Ford models demonstrate exceptional reliability. Research from sources like Consumer Reports can help identify which models have lower repair frequencies.

You Plan to Sell Within 3-4 Years

If you typically trade in vehicles before the factory warranty expires, an extended plan provides little benefit unless you’re using its transferability to increase resale value.

You Have Substantial Emergency Savings

Financial advisors often suggest self-insuring for car repairs by maintaining an emergency fund rather than purchasing extended coverage. If you have $3,000+ set aside for unexpected repairs, you might come out ahead by skipping the warranty.

Making a Smart Decision on Ford’s Extended Warranty

To determine if Ford’s extended warranty is worth it for your situation, consider:

- Your vehicle’s reliability record – Research your specific model’s repair history

- Your ownership timeline – How long will you keep the vehicle?

- Your risk tolerance – How would an unexpected $2,000 repair affect your finances?

- Coverage timing – Purchasing before your factory warranty expires often secures better rates

Remember that Ford offers a 30-day money-back guarantee on their extended warranties, giving you time to reconsider your purchase.

The Coverage Sweet Spot

The best value typically lies in the PremiumCARE plan purchased for vehicles you’ll keep 6+ years, especially models with advanced technology. This comprehensive coverage often pays for itself with a single major repair.

For budget-conscious owners, ExtraCARE provides a middle ground, covering enough crucial systems to prevent financial hardship while keeping costs reasonable.

Negotiating Your Ford Warranty

Unlike the sticker price on vehicles, extended warranty costs have significant wiggle room. Dealers typically mark up these plans by 100% or more.

Tips for getting the best deal:

- Shop multiple dealers for quotes

- Consider buying near the end of the month when salespeople are meeting quotas

- Don’t buy on the same day you purchase your vehicle

- Check online Ford warranty retailers who often offer lower pricing

Many buyers report saving 30-40% by shopping online Ford warranty providers rather than purchasing through their local dealership.

Alternative Protection Options

If Ford’s warranty seems too expensive, consider these alternatives:

- Mechanical breakdown insurance – Insurance-based protection with different coverage terms

- Dealer service plans – Less comprehensive but often cheaper

- Self-insuring – Setting aside money monthly for potential repairs

- Certified Pre-Owned (CPO) – Used Fords with extended factory coverage

Manufacturers’ CPO programs often provide better value than standalone extended warranties.

The Bottom Line on Ford Extended Warranties

A Ford extended warranty isn’t inherently good or bad – it’s a financial product that provides value in specific circumstances. For owners of complex, tech-heavy models who plan long-term ownership, the peace of mind and repair coverage often justify the cost.

For those with reliable models, substantial savings, or short ownership periods, the numbers typically don’t work in your favor.

The smartest approach is evaluating your specific situation, researching your model’s reliability through the National Highway Traffic Safety Administration database, and making a decision based on your personal risk tolerance and financial situation.

Remember: the best warranty is the one that addresses your specific concerns at a price that feels reasonable for the protection it provides.