Ever wondered what happens when your brand-new Ford turns into a lemon? Or maybe you’ve gotten one of those “We want to buy your car” letters and you’re not sure what’s real anymore. The Ford buyback program isn’t just one thing—it’s actually a whole ecosystem of different scenarios where Ford takes your vehicle back. Let’s break down what’s actually going on.

What Is the Ford Buyback Program?

Here’s the deal: there’s no single “Ford buyback program” you can just sign up for. Instead, there are three main situations where Ford might buy back your vehicle.

First, there’s the legal route. If your Ford has a serious defect that Ford can’t fix after multiple tries, you might qualify for a buyback under Lemon Law. This is a legal right protected by the Magnuson-Moss Warranty Act and state-specific laws.

Second, there’s the crisis mode. When Ford issues a major safety recall and doesn’t have the parts to fix it, they might offer to buy back affected vehicles. Think fires, battery failures, or structural problems that can’t wait.

Third, there’s the dealer hustle. Those “vehicle exchange program” mailers? They’re just dealerships trying to get more used inventory. Not actually a manufacturer program.

How Lemon Law Buybacks Work

Your Ford qualifies as a lemon when it has a “substantial impairment” that Ford can’t fix. But you can’t just claim lemon status after one bad repair visit.

The Legal Triggers

You need to meet specific thresholds. For safety issues that could cause death or serious injury, Ford gets two attempts to fix it. Just two. After that, you’ve got a case.

For everything else—annoying transmission shudders, faulty infotainment systems, persistent leaks—Ford gets four chances.

There’s another path: if your truck sits in the shop for more than 30 days total, it’s a lemon. Doesn’t matter if it’s one long stay or multiple shorter visits. Those days add up.

This 30-day rule has become huge recently. Parts shortages for models like the Maverick and F-150 Lightning have left vehicles stranded for months. When your new truck collects dust at the dealership while you’re stuck in a rental, Ford starts feeling the heat.

What You Actually Get Back

The buyback calculation is pretty straightforward. Ford refunds your down payment, all your monthly payments, sales tax, registration fees, and any money you spent on towing or rentals because of the defect.

But there’s a catch: the usage fee.

Ford calculates how much “use” you got from the vehicle before it went lemon. The formula divides your purchase price by 120,000 (the assumed vehicle lifespan), then multiplies by the mileage at your first repair attempt.

Say you bought an F-150 Lightning for $80,000. The battery failed at 1,000 miles. Your usage fee would be roughly $666. That’s it. You essentially drove a new electric truck for almost nothing.

The trick? Document everything from day one. When did you first report the problem? That date determines your usage fee. Ford will try to claim later dates to increase their deduction.

Getting Legal Help

Most people don’t fight Ford alone. Lemon law attorneys work on contingency—if you win, Ford pays your legal fees. This structure puts pressure on Ford to settle quickly rather than rack up legal bills.

Firms like Quill & Arrow specialize in these cases. They know the process, they know Ford’s tactics, and they know how to document your claim properly.

What Happens to Buyback Vehicles

Think Ford crushes every lemon? Not even close. Most enter Ford’s Reacquired Vehicle (RAV) program.

The Inspection Process

After Ford takes your vehicle back, it goes to a specialized auction facility. But before it can be sold, Ford must fix whatever made it a lemon. That’s the law—you can’t sell a defective vehicle without correcting the problem.

Vehicles with unfixable safety issues or fire damage? Those get scrapped. But most get repaired to factory specs and resold.

The Lemon Brand Stigma

Here’s what buyers need to know: these vehicles carry a permanent title brand. “Lemon Law Buyback,” “Manufacturer Repurchase,” or “Warranty Return”—it shows up on every CarFax report forever.

Dealers must disclose this when selling. They’ll hand you a form listing the original defects and what Ford did to fix them.

Why People Buy Them

Price. RAVs sell for 15-25% below market value. On an F-150 King Ranch, that’s $10,000-$15,000 off.

Dealers market these aggressively. They’ll tell you it wasn’t really a lemon—just a part on backorder for 45 days, so Ford bought it back to keep the customer happy. Whether that’s true varies by vehicle.

Ford sweetens the deal with warranty coverage. You typically get either the remaining factory warranty or a fresh 12-month/12,000-mile warranty, whichever is longer.

Title Type Comparison

| Feature | Clean Title | Reacquired Vehicle (RAV) | Salvage/Rebuilt |

|---|---|---|---|

| Why It’s Available | Trade-in or lease return | Lemon Law repurchase | Accident/flood damage |

| Who Fixed It | Dealer service dept | Ford factory repair | Body shop |

| Title Status | No brand | “Lemon Law Buyback” brand | “Salvage” or “Rebuilt” brand |

| Warranty | Whatever’s left from factory | 12mo/12k RAV warranty | Usually none |

| Price vs. Market | 100% (baseline) | 75-85% (discounted) | 50-60% (heavily discounted) |

Safety Recall Buybacks

Sometimes Ford faces a fleet-wide crisis where the fix isn’t coming fast enough. That’s when recall buybacks happen.

The Fusion Energi Battery Crisis

The 2019-2020 Ford Fusion Energi recall is textbook crisis management. The Battery Energy Control Module could fail, causing power loss or trunk fires.

Ford ran out of replacement batteries. Their “interim remedy”? Don’t charge your plug-in hybrid. Seriously.

Ford offered buybacks at 115% of the vehicle’s value. Paying extra was cheaper than the brand damage from telling customers not to use their PHEV as designed. The offer expires July 1, 2025—creating urgency to act now.

The Maverick Fire Risk

Multiple Maverick and Expedition recalls involved fire risks from engine block heaters or manufacturing defects. Ford told owners to park outside, away from structures.

If you can’t park your new truck in your garage, is it really usable? Owners stuck in rentals for six months while waiting for replacement engines often got buyback offers. The rental costs alone pushed Ford to cut losses.

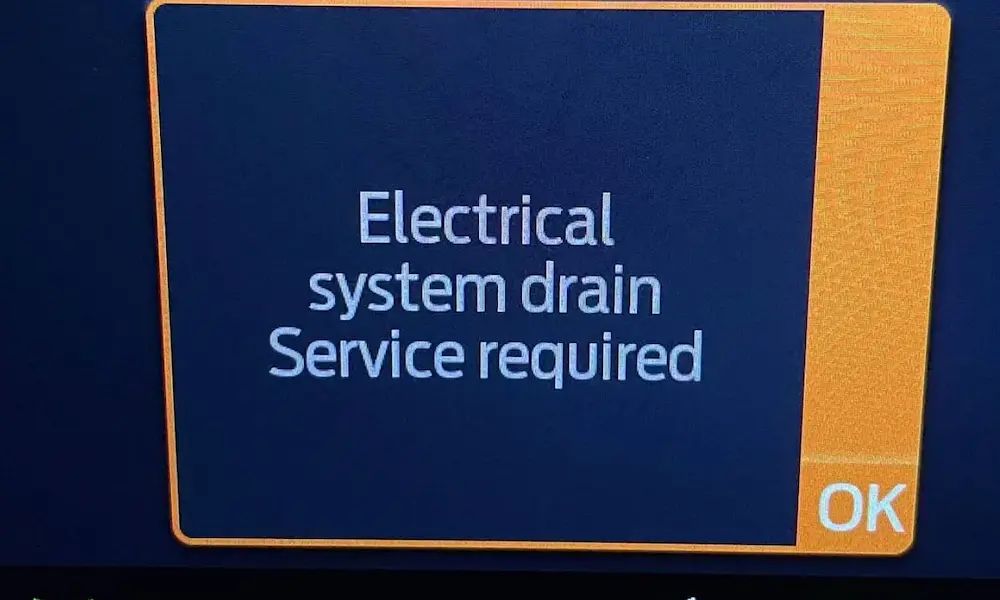

F-150 Lightning Battery Failures

Early Lightning owners reported battery module failures. Unlike gas vehicles where Ford fights buybacks aggressively, Lightning buybacks seemed to get approved relatively quickly.

Why? Ford needs its flagship EV to succeed. Angry early adopters spreading horror stories on social media? That’s a PR nightmare Ford wants to avoid.

The Explorer Frame Rail Defect

This one’s different. Ford recalled certain Explorers and Aviators because the frame rails were formed incorrectly, reducing crash protection.

Ford’s bulletin was blunt: if the frame rails need replacement, owners get a vehicle replacement or buyback. You can’t field-fix a structural defect. The vehicle was built wrong from the factory.

Share Buybacks vs. Vehicle Buybacks

When Wall Street talks about Ford buybacks, they mean shares, not cars. And Ford’s approach is totally different from GM’s.

Why Ford Loves Dividends

GM goes hard on share repurchases—$10 billion in 2023, another $6 billion in 2024. Ford? They pay dividends instead.

Ford targets returning 40-50% of cash flow through a base dividend plus special dividends. In 2023, they paid a massive $0.65 per share special dividend, largely funded by selling their Rivian stake.

The Ford Family Factor

Here’s why: the Ford family controls 40% of voting power through Class B shares. They need income, not share price appreciation.

Dividends give the family cash without diluting their control. Share buybacks increase stock price, but to cash out, the family would need to sell shares—losing voting power in the process.

Ford does some buybacks, but they’re tactical. The goal is offsetting new shares issued for employee compensation, keeping the total share count flat around 4 billion shares.

2025-2026 Outlook

Don’t expect big special dividends or buybacks soon. The Rivian stake is sold. The EV division is burning billions. Ford needs cash for the Tennessee electric truck plant and battery factories.

Capital Return Strategy: Ford vs. GM

| What | Ford | GM |

|---|---|---|

| Main Strategy | High dividends + special dividends | Aggressive share buybacks |

| Who Controls | Ford family (Class B shares) | Institutional investors |

| Buyback Goal | Offset dilution (neutral) | Reduce shares / boost earnings |

| 2023 Special Payout | $0.65/share (from Rivian sale) | None (focused on buybacks) |

Global Buyback Programs

The buyback concept adapts to different markets in creative ways.

Australia & New Zealand’s Guaranteed Future Value

Ford Financial Services offers FAFV in Australia and New Zealand—basically a pre-agreed buyback price.

You finance your vehicle with a guaranteed trade-in value at the end (usually 3-4 years). If the market crashes, you walk away and Ford eats the loss.

This is huge for EVs like the Mustang Mach-E. Buyers terrified of battery obsolescence and plummeting resale values get protection. Ford takes the risk.

Singapore’s Unique System

Singapore’s Certificate of Entitlement (COE) system creates a government-backed buyback floor. Deregister your car early, and you get rebates on your COE and registration fees.

Ford dealers leverage this. They can offer above-market trade-in values because they know the government rebate underwrites the “scrap” value.

Dealer “Exchange Programs” Explained

Got a mailer saying Ford desperately wants your truck back? That’s dealer marketing, not Ford corporate.

How It Works

Dealers scan customer databases for high-demand models with loan equity. They send mailers offering to “buy back” your vehicle.

The goal? Get used inventory without auction fees and sell you a new vehicle. It’s a trade-in offer dressed up as something special.

These offers are legitimate commercial transactions. But there’s no legal obligation, no connection to defects, and no manufacturer involvement beyond the dealer’s franchise agreement.

What This Means for You

The Ford buyback landscape tells you about Ford’s quality issues. In 2024, Ford led the industry in recalls—not exactly a badge of honor.

As vehicles become software-defined, expect more buybacks driven by code problems, not hardware. An over-the-air update that doesn’t fix a safety issue still means your vehicle sits unusable while Ford works on version 2.0.

For investors, watch the dividend, not share buybacks. Ford needs cash for the EV transition and warranty reserves. The family wants dividends. Massive share repurchases aren’t coming.

For buyers, understand your rights. Document every service visit from day one. Know the thresholds. Get legal help if needed. And if you’re buying a RAV? Get that title history, understand what was fixed, and make sure you’re comfortable with the discount matching the risk.

The “Ford buyback” you’re dealing with depends entirely on your situation—legal remedy, safety crisis, capital return, or marketing tactic. Know which one you’re facing, and you’ll know what to expect.