Thinking about protecting your Ford vehicle beyond the standard warranty? You’re likely wondering if investing in Ford Protect is actually worth it. With prices ranging from $1,500 to $7,000, it’s not a decision to take lightly. Let’s dive into what Ford Protect offers, what it costs, and when it might (or might not) be a smart investment for your situation.

What Exactly Is Ford Protect?

Ford Protect Extended Service Plans (ESP) are factory-backed warranty extensions that kick in after your original warranty expires. Unlike third-party warranties, these plans are fully backed by Ford Motor Company, giving them significant credibility.

When your standard 3-year/36,000-mile bumper-to-bumper warranty runs out, Ford Protect keeps you covered for mechanical breakdowns that would otherwise come straight out of your pocket.

Coverage Options: From Basic to Comprehensive

Ford offers four main coverage levels to match different needs and budgets:

PremiumCARE: The most comprehensive option covering over 1,000 components including the engine, transmission, electrical systems, and high-tech features. If maximum peace of mind is your priority, this is the plan to consider.

ExtraCARE: Covers 113 components focused on your vehicle’s drivability and performance components.

BaseCARE: Provides protection for 84 key components that are essential to your vehicle’s operation.

PowertrainCARE: Basic coverage for 29 critical engine and transmission components – the expensive core systems of your vehicle.

Coverage can extend up to 10 years or 175,000 miles, making it one of the longest-term protection options in the automotive industry.

What Will Ford Protect Cost You?

The price varies significantly based on several factors:

- Your specific Ford model and year

- Which coverage level you select

- How long you want coverage

- The deductible amount you choose

Based on real-world quotes, here’s what you can expect to pay:

| Vehicle Model | PremiumCARE (8yr/100k miles) | PowertrainCARE |

|---|---|---|

| Ford F-150 | ~$3,080 | $1,800-2,200 |

| Ford Escape | ~$2,772 | $1,500-1,900 |

| Ford Bronco | ~$5,735 | ~$2,950 |

The average cost across all models is approximately $1,314, but technology-packed vehicles or performance models will typically cost more to cover.

Key Benefits Beyond Basic Repairs

Ford Protect isn’t just about covering repair costs. It includes several valuable extras:

-

Genuine Ford Parts: All repairs use original Ford parts installed by factory-trained technicians, ensuring quality repairs.

-

Rental Vehicle Coverage: If your vehicle needs overnight repairs, you’ll get up to 10 days of rental coverage at $60 per day.

-

24/7 Roadside Assistance: Includes towing assistance up to $100 per occurrence, emergency travel expenses up to $1,000, and other roadside services when you’re stranded.

-

Transferable Coverage: If you sell your vehicle, the plan transfers to the new owner, potentially boosting your resale value.

-

Interest-Free Financing: You can include the cost in your vehicle payments without added interest for up to 30 months.

-

Nationwide Service Access: Get covered repairs at any Ford or Lincoln dealership across the U.S., Canada, and Mexico.

When Ford Protect Makes Financial Sense

If You’ve Got a Less Reliable Model

Ford ranked 23rd out of 29 carmakers for dependability in J.D. Power’s 2024 rankings. This lower-than-average reliability rating actually strengthens the case for extended warranty coverage, as you’re statistically more likely to need repairs compared to other brands.

If Your Ford Is Loaded With Tech

Modern Fords often come packed with technology – from SYNC infotainment systems to driver-assist features. If your vehicle has:

- Adaptive cruise control

- Lane-keeping systems

- Blind spot monitoring

- Voice-activated navigation

- Digital dashboards

These complex electronic systems can be extremely expensive to repair when they fail. Ford Protect’s PremiumCARE specifically covers these high-tech components that might otherwise cost thousands to fix.

If You’re Planning Long-Term Ownership

Most people keep their vehicles well beyond the standard 3-year factory warranty. If you plan to own your Ford for 5+ years, extended coverage provides greater value as components age and wear increases.

The sweet spot for extended warranty value is typically years 4-8 of ownership, when major components start to fail but the vehicle isn’t yet old enough to consider replacement.

If You Prefer Predictable Expenses

Some car owners would rather pay a fixed, predictable amount upfront than risk unexpected repair bills. If budget predictability is important to you, Ford Protect essentially converts unpredictable repair costs into a fixed expense you can plan for.

When Ford Protect May Not Be Worth It

If You’re Looking at Pure Statistics

Consumer Reports surveys have consistently shown that car owners typically pay more for extended warranty coverage than they receive back in covered repairs. Statistically speaking, the house usually wins in the warranty game.

On average, those who bought extended warranties spent $1,214 on coverage but only about $837 on repairs that would have been covered, according to Consumer Reports data.

If You’re Mechanically Savvy

If you can handle basic to intermediate repairs yourself, or have a trusted independent mechanic who charges reasonable rates, you might be better off setting aside the warranty money in a dedicated repair fund.

If You Don’t Keep Vehicles Long

If you typically trade in your vehicles every 3-4 years, you may never use the extended coverage you paid for. Most major issues tend to occur beyond the 5-year mark.

Ford Reliability: The Good and Bad

Understanding Ford’s reliability helps determine if extended coverage makes sense. Here’s where Ford vehicles typically excel and struggle:

Common Strength Areas:

- Powertrain durability in F-Series trucks

- Simplicity of base-model vehicles

- Availability of affordable parts

Common Problem Areas:

- Transmission issues (particularly in some Focus and Fiesta models)

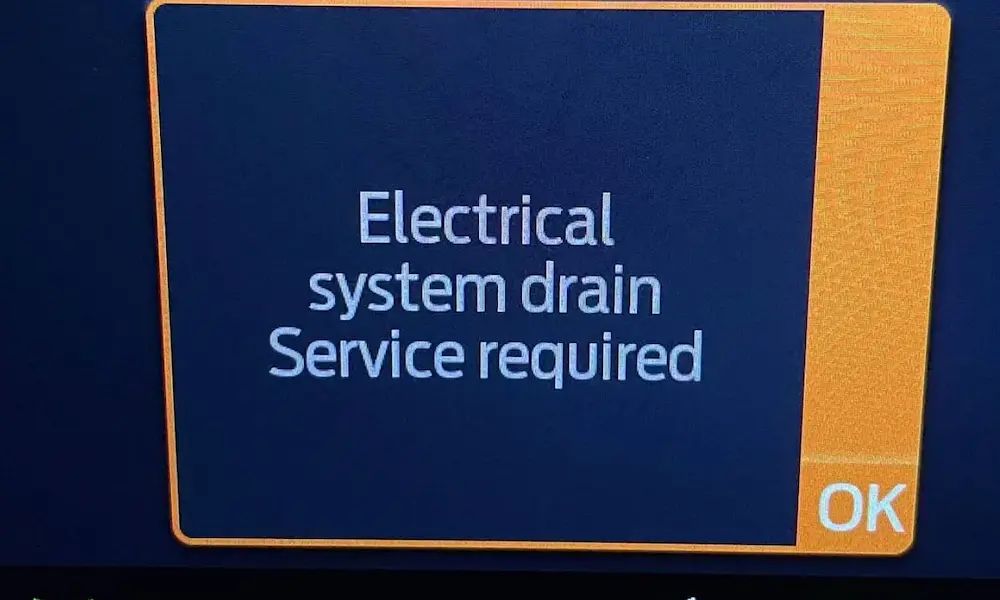

- Electrical system gremlins

- Infotainment system glitches

- Power equipment failures

These known weak points make extended coverage more valuable for certain models, especially those with complex systems or known issues.

Price Negotiation: Getting the Best Deal

The sticker price for Ford Protect isn’t set in stone. Here’s how to secure a better rate:

-

Shop between dealerships: Prices can vary by thousands between different Ford dealers for identical coverage.

-

Buy early: Purchasing Ford Protect when you buy your new vehicle often results in lower prices.

-

Consider online Ford dealers: Many Ford dealerships sell legitimate Ford Protect plans online at significant discounts compared to local dealers.

-

Ask for price matching: If you find a better price from another authorized seller, ask your dealer to match it.

-

Adjust your deductible: Choosing a $100 or $200 deductible instead of $0 can substantially lower your premium.

Making Your Decision: A Quick Assessment

Answer these questions to help determine if Ford Protect makes sense for you:

-

Do you plan to keep your Ford beyond the factory warranty period?

If yes, extended coverage becomes more valuable. -

Does your Ford have advanced technology features?

More technology means more potential for expensive electronic repairs. -

Is your budget flexible enough to handle unexpected $1,000+ repair bills?

If not, the predictable cost of warranty coverage might be preferable. -

Is your specific Ford model known for reliability issues?

Some models have better histories than others — research your specific vehicle. -

Do you drive more than 15,000 miles annually?

High-mileage drivers see more value from extended coverage.

Alternatives to Ford Protect

If you’re not convinced Ford Protect is right for you, consider these alternatives:

Self-Insuring: Set aside the same amount you’d pay for Ford Protect in a dedicated “car repair fund.” If you don’t use it, you keep the money.

Third-Party Warranties: Companies like CarShield, Endurance, and CARCHEX offer competing plans, sometimes at lower prices (though often with more coverage limitations and less streamlined claims processes).

Certified Pre-Owned (CPO): If you’re buying used, a CPO Ford comes with an extended powertrain warranty and additional benefits without requiring a separate purchase.

Real-World Ford Protect Experiences

Customer reviews of Ford Protect are mixed, with experiences largely depending on individual circumstances:

“The PremiumCARE plan saved me over $4,200 when my navigation system and climate control failed just after the factory warranty expired.” – Ford Edge owner

“I paid $2,800 for coverage I never used once in five years of ownership. Complete waste of money for my F-150.” – F-150 owner

“Having rental car coverage alone was worth it when my Escape was in the shop for a week.” – Escape owner

The consensus suggests that while some owners never recoup their investment, many value the peace of mind and protection from catastrophic repair bills.

Is Ford Protect Worth It? The Bottom Line

Ford Protect can be worth it if:

- You own a technology-heavy Ford model

- You plan to keep your vehicle for 5+ years

- Your specific model has known reliability issues

- You value predictable vehicle expenses

- You want the convenience of dealer service and genuine parts

It’s probably not worth it if:

- You rarely keep vehicles beyond 3-4 years

- You’re comfortable with DIY repairs

- Your model has a strong reliability record

- You’re purely focused on financial return rather than peace of mind

Like most insurance products, the true value of Ford Protect lies in risk mitigation and peace of mind rather than guaranteed financial return. You might never need it, but when you do, you’ll be glad you have it.